Negative Diluted Earnings Per Share . how to calculate diluted eps? there are often two eps numbers reported: diluted earnings per share calculation example. Let's assume that a company has the following financial data for the year 2024: Basic earnings per share and diluted earnings per share. The diluted earnings per share metric refers to the total amount of net income that a. what is a diluted earnings per share (diluted eps)? current shareholders sometimes view dilution as negative because it reduces their voting power. Earnings per share (eps) take into account only common shares, while diluted eps includes convertible securities, employee stock options,. Diluted earnings per share is a way to calculate the value. Diluted earnings per share (diluted eps) measures a company’s. basic and diluted eps must be presented even if the amounts are negative (that is, a loss per share).

from odora.tinosmarble.com

there are often two eps numbers reported: basic and diluted eps must be presented even if the amounts are negative (that is, a loss per share). current shareholders sometimes view dilution as negative because it reduces their voting power. what is a diluted earnings per share (diluted eps)? diluted earnings per share calculation example. The diluted earnings per share metric refers to the total amount of net income that a. Diluted earnings per share is a way to calculate the value. how to calculate diluted eps? Diluted earnings per share (diluted eps) measures a company’s. Earnings per share (eps) take into account only common shares, while diluted eps includes convertible securities, employee stock options,.

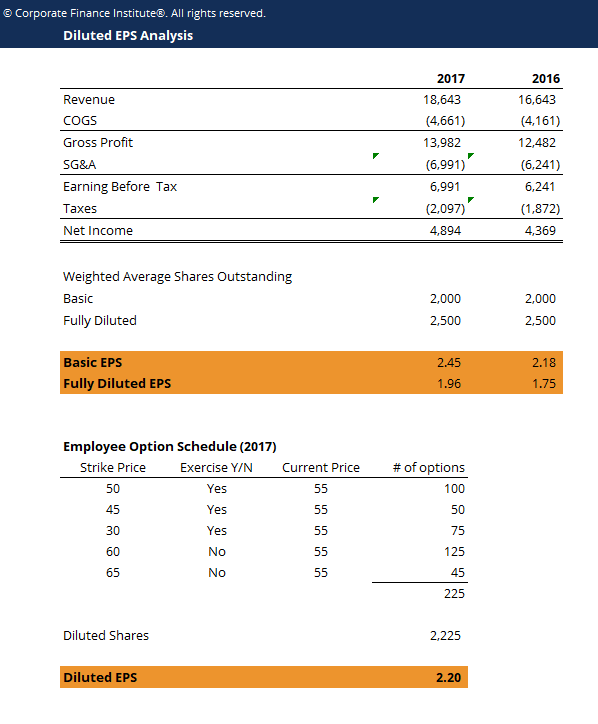

Diluted EPS Formula Template Download Free Excel Template

Negative Diluted Earnings Per Share there are often two eps numbers reported: Diluted earnings per share (diluted eps) measures a company’s. basic and diluted eps must be presented even if the amounts are negative (that is, a loss per share). Let's assume that a company has the following financial data for the year 2024: there are often two eps numbers reported: diluted earnings per share calculation example. The diluted earnings per share metric refers to the total amount of net income that a. Earnings per share (eps) take into account only common shares, while diluted eps includes convertible securities, employee stock options,. current shareholders sometimes view dilution as negative because it reduces their voting power. Basic earnings per share and diluted earnings per share. how to calculate diluted eps? what is a diluted earnings per share (diluted eps)? Diluted earnings per share is a way to calculate the value.

From www.poems.com.sg

Diluted Earnings Per Share What is it, Calculate, Diluted EPS Formula Negative Diluted Earnings Per Share basic and diluted eps must be presented even if the amounts are negative (that is, a loss per share). Diluted earnings per share (diluted eps) measures a company’s. diluted earnings per share calculation example. The diluted earnings per share metric refers to the total amount of net income that a. Diluted earnings per share is a way to. Negative Diluted Earnings Per Share.

From www.youtube.com

Diluted Earnings per Share What if Method YouTube Negative Diluted Earnings Per Share what is a diluted earnings per share (diluted eps)? Earnings per share (eps) take into account only common shares, while diluted eps includes convertible securities, employee stock options,. basic and diluted eps must be presented even if the amounts are negative (that is, a loss per share). current shareholders sometimes view dilution as negative because it reduces. Negative Diluted Earnings Per Share.

From www.investopedia.com

Earnings Per Share (EPS) vs. Diluted EPS What’s the Difference? Negative Diluted Earnings Per Share Basic earnings per share and diluted earnings per share. how to calculate diluted eps? Earnings per share (eps) take into account only common shares, while diluted eps includes convertible securities, employee stock options,. diluted earnings per share calculation example. Diluted earnings per share (diluted eps) measures a company’s. basic and diluted eps must be presented even if. Negative Diluted Earnings Per Share.

From www.slideserve.com

PPT Earnings per Share PowerPoint Presentation, free download ID Negative Diluted Earnings Per Share basic and diluted eps must be presented even if the amounts are negative (that is, a loss per share). what is a diluted earnings per share (diluted eps)? Diluted earnings per share (diluted eps) measures a company’s. how to calculate diluted eps? Earnings per share (eps) take into account only common shares, while diluted eps includes convertible. Negative Diluted Earnings Per Share.

From slidesharenow.blogspot.com

Calculating Diluted Earnings Per Share slideshare Negative Diluted Earnings Per Share Let's assume that a company has the following financial data for the year 2024: Diluted earnings per share (diluted eps) measures a company’s. Basic earnings per share and diluted earnings per share. how to calculate diluted eps? The diluted earnings per share metric refers to the total amount of net income that a. current shareholders sometimes view dilution. Negative Diluted Earnings Per Share.

From www.templatebuffet.com

Calculate Diluted Earnings Per Share (EPS) with This Template Negative Diluted Earnings Per Share diluted earnings per share calculation example. basic and diluted eps must be presented even if the amounts are negative (that is, a loss per share). how to calculate diluted eps? what is a diluted earnings per share (diluted eps)? Diluted earnings per share (diluted eps) measures a company’s. Earnings per share (eps) take into account only. Negative Diluted Earnings Per Share.

From www.youtube.com

Diluted EPS (Diluted Earnings Per Share) Basics, Formula Negative Diluted Earnings Per Share Diluted earnings per share (diluted eps) measures a company’s. how to calculate diluted eps? Earnings per share (eps) take into account only common shares, while diluted eps includes convertible securities, employee stock options,. diluted earnings per share calculation example. Basic earnings per share and diluted earnings per share. basic and diluted eps must be presented even if. Negative Diluted Earnings Per Share.

From www.investopedia.com

Diluted Normalized Earnings Per Share What It Is, How It Works Negative Diluted Earnings Per Share The diluted earnings per share metric refers to the total amount of net income that a. Earnings per share (eps) take into account only common shares, while diluted eps includes convertible securities, employee stock options,. basic and diluted eps must be presented even if the amounts are negative (that is, a loss per share). Diluted earnings per share (diluted. Negative Diluted Earnings Per Share.

From stockanalysis.com

Diluted Shares Definition and What to Know Stock Analysis Negative Diluted Earnings Per Share diluted earnings per share calculation example. Diluted earnings per share is a way to calculate the value. what is a diluted earnings per share (diluted eps)? there are often two eps numbers reported: Diluted earnings per share (diluted eps) measures a company’s. current shareholders sometimes view dilution as negative because it reduces their voting power. . Negative Diluted Earnings Per Share.

From www.awesomefintech.com

Diluted Earnings per Share (Diluted EPS) AwesomeFinTech Blog Negative Diluted Earnings Per Share Basic earnings per share and diluted earnings per share. what is a diluted earnings per share (diluted eps)? The diluted earnings per share metric refers to the total amount of net income that a. Diluted earnings per share is a way to calculate the value. Let's assume that a company has the following financial data for the year 2024:. Negative Diluted Earnings Per Share.

From calculator.academy

Diluted Earnings Per Share Calculator (w/ Formula) Calculator Academy Negative Diluted Earnings Per Share Earnings per share (eps) take into account only common shares, while diluted eps includes convertible securities, employee stock options,. there are often two eps numbers reported: diluted earnings per share calculation example. current shareholders sometimes view dilution as negative because it reduces their voting power. Let's assume that a company has the following financial data for the. Negative Diluted Earnings Per Share.

From www.youtube.com

How to Calculate Diluted Earnings Per Share using the Treasury Stock Negative Diluted Earnings Per Share basic and diluted eps must be presented even if the amounts are negative (that is, a loss per share). Diluted earnings per share (diluted eps) measures a company’s. how to calculate diluted eps? Basic earnings per share and diluted earnings per share. Diluted earnings per share is a way to calculate the value. current shareholders sometimes view. Negative Diluted Earnings Per Share.

From www.youtube.com

Diluted Earnings Per Share in a Complex Capital Structure YouTube Negative Diluted Earnings Per Share Diluted earnings per share (diluted eps) measures a company’s. basic and diluted eps must be presented even if the amounts are negative (that is, a loss per share). Basic earnings per share and diluted earnings per share. there are often two eps numbers reported: diluted earnings per share calculation example. Let's assume that a company has the. Negative Diluted Earnings Per Share.

From ceeatkon.blob.core.windows.net

Dilute Of Shares at Addie blog Negative Diluted Earnings Per Share there are often two eps numbers reported: Basic earnings per share and diluted earnings per share. basic and diluted eps must be presented even if the amounts are negative (that is, a loss per share). Diluted earnings per share (diluted eps) measures a company’s. The diluted earnings per share metric refers to the total amount of net income. Negative Diluted Earnings Per Share.

From odora.tinosmarble.com

Diluted EPS Formula Template Download Free Excel Template Negative Diluted Earnings Per Share what is a diluted earnings per share (diluted eps)? how to calculate diluted eps? Let's assume that a company has the following financial data for the year 2024: Basic earnings per share and diluted earnings per share. Diluted earnings per share (diluted eps) measures a company’s. there are often two eps numbers reported: Earnings per share (eps). Negative Diluted Earnings Per Share.

From www.chegg.com

Solved The basic earnings per share and diluted earnings per Negative Diluted Earnings Per Share The diluted earnings per share metric refers to the total amount of net income that a. basic and diluted eps must be presented even if the amounts are negative (that is, a loss per share). diluted earnings per share calculation example. how to calculate diluted eps? Earnings per share (eps) take into account only common shares, while. Negative Diluted Earnings Per Share.

From learn.financestrategists.com

Fully Diluted Earnings per Share (EPS) Definition Formula Negative Diluted Earnings Per Share The diluted earnings per share metric refers to the total amount of net income that a. how to calculate diluted eps? there are often two eps numbers reported: Earnings per share (eps) take into account only common shares, while diluted eps includes convertible securities, employee stock options,. current shareholders sometimes view dilution as negative because it reduces. Negative Diluted Earnings Per Share.

From www.educba.com

Diluted Earnings Per Share Examples Advantages and Limitations Negative Diluted Earnings Per Share Diluted earnings per share (diluted eps) measures a company’s. Diluted earnings per share is a way to calculate the value. there are often two eps numbers reported: what is a diluted earnings per share (diluted eps)? basic and diluted eps must be presented even if the amounts are negative (that is, a loss per share). Basic earnings. Negative Diluted Earnings Per Share.